Kohl’s is a well-known department store that sells everything from apparel to household items. Kohl’s also offers a credit card program that provides exclusive benefits and rewards for frequent shoppers. Users intend to know about the program so we will help you!

The Kohl’s Credit Card Program

The Kohl’s credit card program includes two types: the Kohl’s Charge Card and the Kohl’s Credit Card. The Kohl’s Charge Card is a store card that can only be used at Kohl’s, but the Kohl’s Credit Card can be used everywhere where Visa is accepted. Both types of cards offer the same rewards and benefits, but Kohl’s Credit Card can be used more widely.

To apply for a Kohl’s credit card, you can do so in-store or online. The application process is really simple and easy. You must provide basic personal and financial information, such as your name, address, and income. To be accepted for a Kohl’s credit card, you must satisfy specific standards, such as having a decent credit score.

Benefits of the Kohl’s Credit Card Program

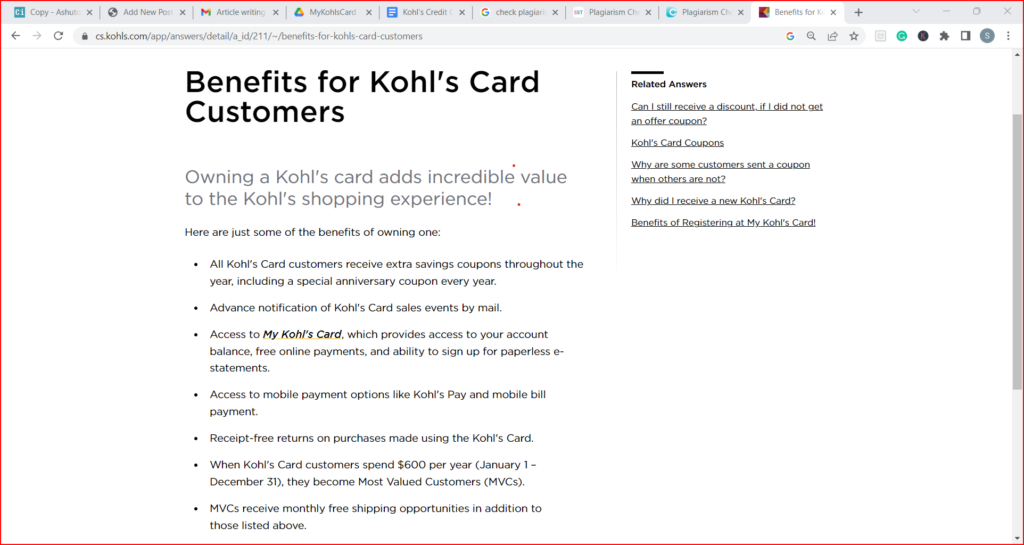

If you shop at www.mykohlscard.com often, customers should consider signing up for the My Kohl’s Charge Card. This credit card has several advantages that may help you save money and earn rewards.

- One of the biggest perks of the My Kohl’s Charge Card is the 35% discount on your first purchase. Whether you shop in-store or online, you can enjoy significant savings on your initial transaction. And once your card arrives in the mail, you’ll receive a coupon for 15% off your next purchase.

- But the benefits don’t stop there. With the My Kohl’s Charge Card, you’ll receive at least 12 special offers each year, giving you exclusive discounts and promotions. And if you spend $600 or more in a year, you’ll be considered a Most Valued Customer and receive 18 additional discounts annually.

- Perhaps one of the most attractive features of the My Kohl’s Charge Card is the absence of an annual fee. Unlike many other credit cards, you won’t be charged a fee just for keeping your card active.

- However, it’s important to note that the My Kohl’s Charge Card does have a high APR of 26.49% Variable. If you carry a balance on your card, you will be charged interest at a greater rate than most other credit cards.

- To help offset the high APR, you can sign up for the Yes2You rewards program and link it to your My Kohl’s Charge Card. This program offers a $5 coupon for every 100 points you earn, which can be used towards future purchases at Kohl’s.

- Yes2You members also receive eight exclusive discounts each year, as well as a $10 birthday gift. And if you link your Yes2You account to the Kohl’s app, you can easily keep track of your rewards and coupons.

- In addition to these benefits, the My Kohl’s Charge Card also offers Kohl’s Pay, which allows you to pay with your card even if you don’t have it on you. You can also set up My Kohl’s Charge AutoPay, which will automatically make payments on your balance statement from a linked checking, savings, or money market account.

- Free shipping on all purchases is another advantage of Kohl’s credit card program. This is particularly useful if you regularly purchase online or live far away from a Kohl’s store. By using your Kohl’s credit card, you can enjoy free shipping on all of your purchases, no matter how small.

- Access to exclusive offers is another advantage of Kohl’s credit card program. Cardholders get emails and updates about amazing deals and promotions that the general public cannot access. This is a terrific way to keep up to date on the newest offers and get even more bang for your buck.

- Hassle-free returns are also part of Kohl’s credit card program. If you need to return an item, you can do so without a receipt, and the purchase will be credited to your Kohl’s credit card. This makes the return process easy and convenient, saving you time and hassle.

Overall, the My Kohl’s Charge Card is an excellent choice for regular Kohl’s shoppers looking to save money and receive benefits. To prevent enormous interest costs, pay off your debt each month.

Rates & Fees

The My Kohl’s Charge Card offers a variable Annual Percentage Rate (APR) for purchases, currently at 26.49%. This rate may fluctuate with market changes based on the Prime Rate. However, there is no APR for balance transfers or cash advances, and there is no penalty APR.

It is critical to make timely payments to avoid incurring interest on purchases. You have 25 calendar days following the conclusion of each billing cycle to pay. You will not be charged interest on future purchases if you pay your monthly debt before the due date.

The My Kohl’s Charge Card does not charge an annual fee. However, late and returned payments may incur penalty fees of up to $38 each. To prevent these fines, you must complete your payments on schedule.

My Kohl’s Card provides users with various benefits and perks. It offers discounts on first purchases, access to exclusive offers, and hassle-free returns. Additionally, the card provides opportunities to earn rewards through the Yes2You and Kohl’s Cash rewards programs. While the APR for purchases is high and variable, paying full and timely balances can help avoid interest charges. The My Kohl’s Card is a convenient and rewarding option for Kohl’s shoppers, with no annual fee and multiple payment methods available.

If you have any questions regarding mykohlscard then you can check out our troubleshooting kohl’s card guide.